Client overview

Bond Lab is a U.S.-based fintech company dedicated to delivering high-quality fixed-income analytics emphasizing speed, reliability, and affordability. Their team comprises seasoned professionals from Wall Street, including portfolio managers, deal structurers, and experts in artificial intelligence and real-time architectures. This diverse expertise underpins their mission to provide next-generation analytics and applications, enabling market participants to invest and operate more effectively.

The challenge

Bond Lab approached us with an incomplete and fragmented analytics platform. The existing system suffered from:

- Incomplete Codebase: Significant portions of the code were missing or undocumented, hindering functionality.

- System Integration Issues: Disparate components lacked cohesion, leading to operational inefficiencies.

- Performance Bottlenecks: The PostgreSQL database exhibited slow query execution, impeding analytical processes.

- Limited Access Control: The absence of a secure API and web interface restricted authorized user access.

Our solution

To address these challenges, our team implemented a comprehensive redevelopment strategy:

- Code Reconstruction: We meticulously rebuilt the missing code segments, restoring full system functionality.

- System Integration: Our engineers seamlessly integrated various components, ensuring smooth operation.

- Database Migration: Transitioned from PostgreSQL to Amazon Redshift, significantly enhancing query performance.

- Secure Access Development: Developed a secure API and web interface, facilitating authorized user interactions.

- Deployment Optimization: Utilized Docker technology to enable clients to deploy ready-to-use system copies effortlessly.

Technology Stack

- Programming languages: R, Python

- Database: Amazon Redshift

- Infrastructure: AWS Lambda, Docker

- API: GraphQL

Deliverables

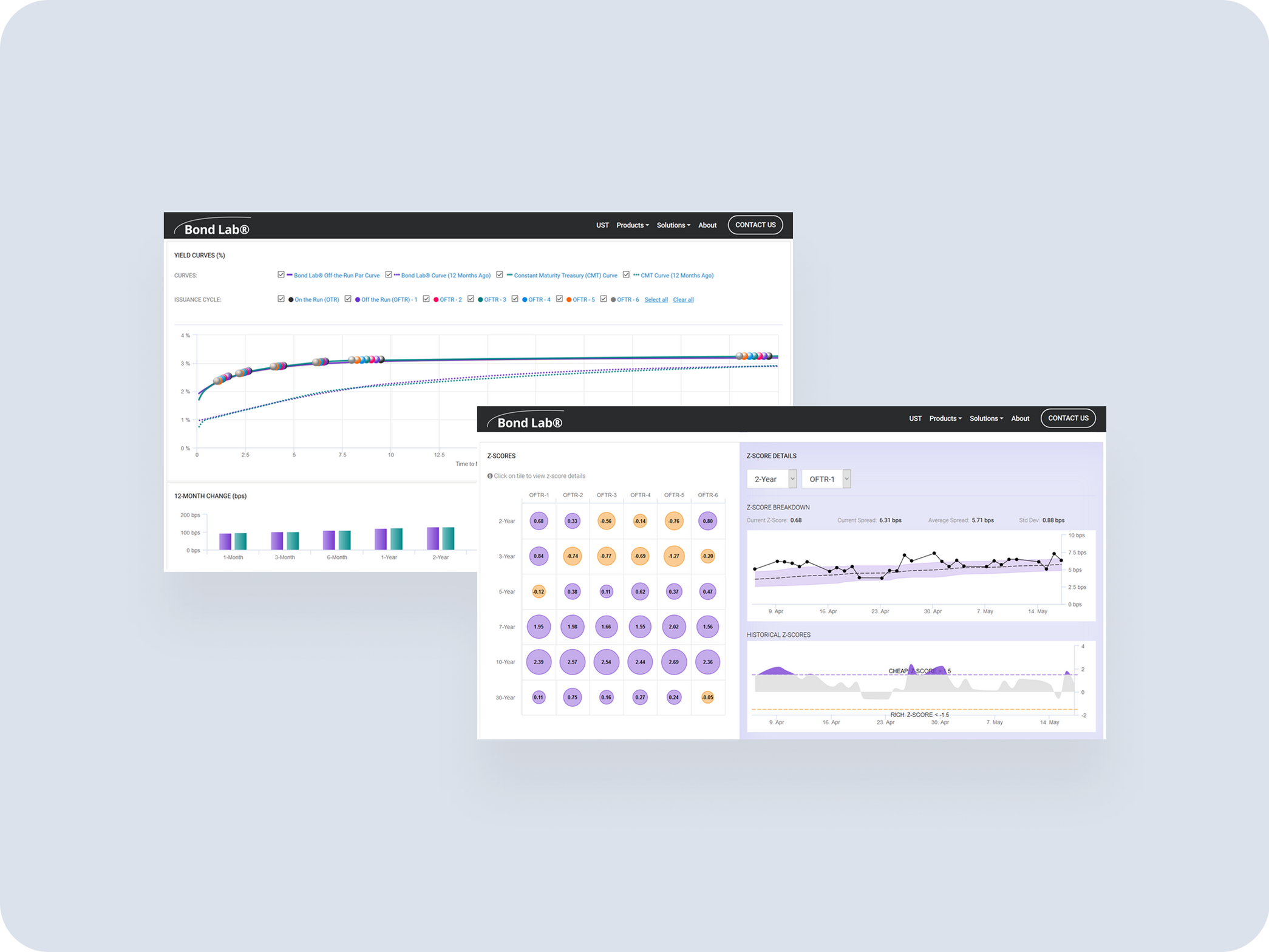

Our collaboration with Bond Lab culminated in a robust, high-performance analytics platform that:

- Restored and completed system functionality, enhancing operational efficiency.

- Delivered a secure, user-friendly API and web interface for authorized access.

- Achieved significant improvements in query execution speed through database optimization.

- Expanded analytical capabilities to meet complex client requirements.

This transformation empowered Bond Lab to offer reliable and efficient fixed-income analytics, enabling their clients to make informed investment decisions with confidence.