About the client

In a world where milliseconds matter and market complexity is constantly evolving, investment firms must rely on more than just instinct and spreadsheets to stay competitive. For Lord Abbett, a leading global asset manager, staying ahead meant transforming its internal research platform into a dynamic, data-driven powerhouse. That’s where Montrose Software AI stepped in.

The challenge: from fragmentation to frictionless insight

Lord Abbett’s portfolio research team needed more than a patchwork of tools and manual processes. Their analysts were struggling with:

- Siloed Data Access: Gathering investment and risk data required switching between systems, slowing down insights.

- Rigid Tooling: Existing workflows were heavily reliant on legacy Excel models that lacked scalability.

- Limited Automation: High-value research time was being consumed by low-value, repetitive tasks.

The vision was clear: an internal platform that empowers analysts to explore, model, and evaluate investments at scale, without sacrificing flexibility.

Our approach: collaborative, context-aware engineering

Montrose assembled a dedicated engineering team to work hand-in-hand with Lord Abbett’s internal users, not just building to requirements, but evolving the product with real-time feedback from its future users.

Key pillars of our approach included:

- User-Driven Design: We embedded directly with analysts to understand their unique research workflows.

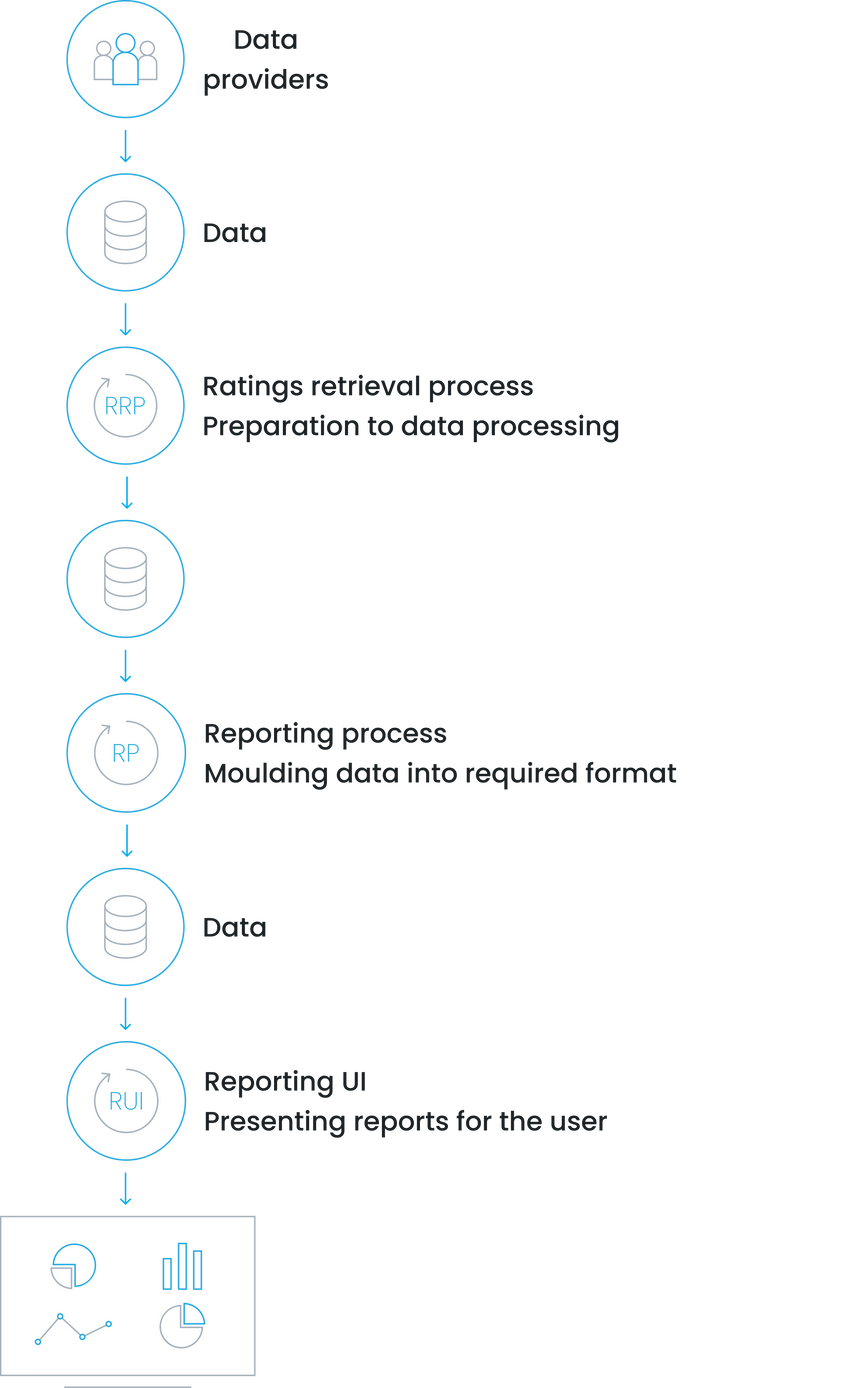

- Componentized Architecture: The platform was built using a modern tech stack (React, TypeScript, Flask), allowing for agile delivery and scalable feature expansion.

- Integration-First Mindset: We connected the system seamlessly with Lord Abbett’s existing data lakes and APIs, turning fragmented data into a unified source of truth.

The Outcome: A Research Platform Built for the Future

The result was the RP (Research Platform): a centralized, cloud-ready system that analysts use daily to assess opportunities, run models, and collaborate on strategies.

The platform delivers:

- Custom Workspaces: Each analyst configures their view with modular components tailored to their investment style.

- Live Data Feeds: Real-time access to risk metrics, financial data, and market analytics.

- Scalable Intelligence: From quick lookups to complex model execution, the platform handles it all, with auditability and control.

Most importantly, the RP platform is built for evolution. As Lord Abbett expands its use of AI and predictive analytics, this platform serves as a launchpad for innovation, ready to ingest new data sources, embed machine learning models, and support more sophisticated decision-making.

Technology Stack

- Programming Languages: Java, Python, Perl

- Database: Azure SQL Server

- Frameworks and Tools: Hibernate, Batch Script, TeamCity

Deliverables

The collaboration led to significant improvements:

- Efficiency: Automated the summarization and dissemination of portfolio statistics, reducing manual intervention.

- Accuracy: Enhanced data consistency and reliability across reports.

- Agility: Adopted agile practices, leading to faster development cycles and improved software quality.

This transformation empowered Lord Abbett to deliver timely and accurate reports to stakeholders, including the board of directors, enhancing decision-making processes.